labuan tax haven

Some of the most popular countries with the distinguishing features of offshore tax havens include. The Bill has four main purposes.

Understanding Labuan S New Tax Framework

However its fixed tax rate of 3 capped at RM20000 per year clearly calls to mind low-tax regime and inevitably Labuan was viewed as a tax haven.

. In Labuan theres no taxes on distributing dividents interests royalty and rent. Labuan has repositioned itself to reflect its enhanced supervisory framework and compliance with international offshore. The Labuan International Offshore Financial Centre IOFC was created in 1990 as Malaysias first offshore financial hub.

Since its inception the jurisdiction has expanded to become a base for more than 6500 offshore companies and more than 300 licensed financial institutions including world leading. Annual corporate rates for companies are 3 or macimum 20000 RM. To update procedures relating to the qualification of a director ascertaining beneficial ownership and striking off a Labuan company and to increase penalties for offences.

Following the implementation of the Base Erosion and Profit Shifting BEPS Action Plan in 2013 by the OECD and G20 countries which led to the. There are many jurisdictions which offer tax advantages and other benefits to offshore investors and companies. Labuan was never intended to be a tax haven and the government of Malaysia has always been on guard against the possibility that it will be abused to facilitate international money laundering.

In 2010 the notion offshore was excluded from all the statutes of Labuan due to world pressure on the tax havens and offshores. In Europe we hear legends about Labuan being the original tax haven for Air Asia 3 tax 7k max and that foreigners are allowed to open companies there and use them to do Business internationally. No taxation for Inverstment holding companies.

Labuan jurisdiction is being conceived with the concept of the mid-shore jurisdiction that provides a half-way point between onshore and offshore also to promote greater tax transparency a strong legal system and a justified tax framework. However its fixed tax rate of 3 capped at RM20000 per year clearly calls to mind low-tax regime and inevitably Labuan was viewed as a tax haven. Some of these are regarded as genuine tax havens whilst others lie somewhere in between.

The jurisdictions many benefits include. Right from the start the Malaysian Government had taken pains to avoid the label tax haven for Labuan and had been vigilant against being used for international money laundering. Malaysias offshore financial center of Labuan an island designated as Special.

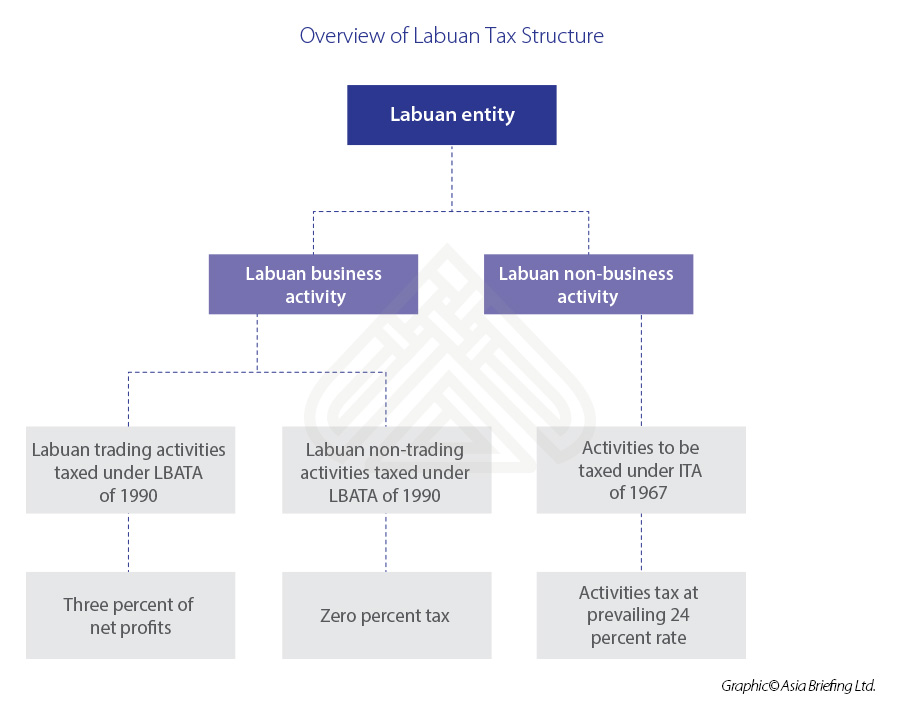

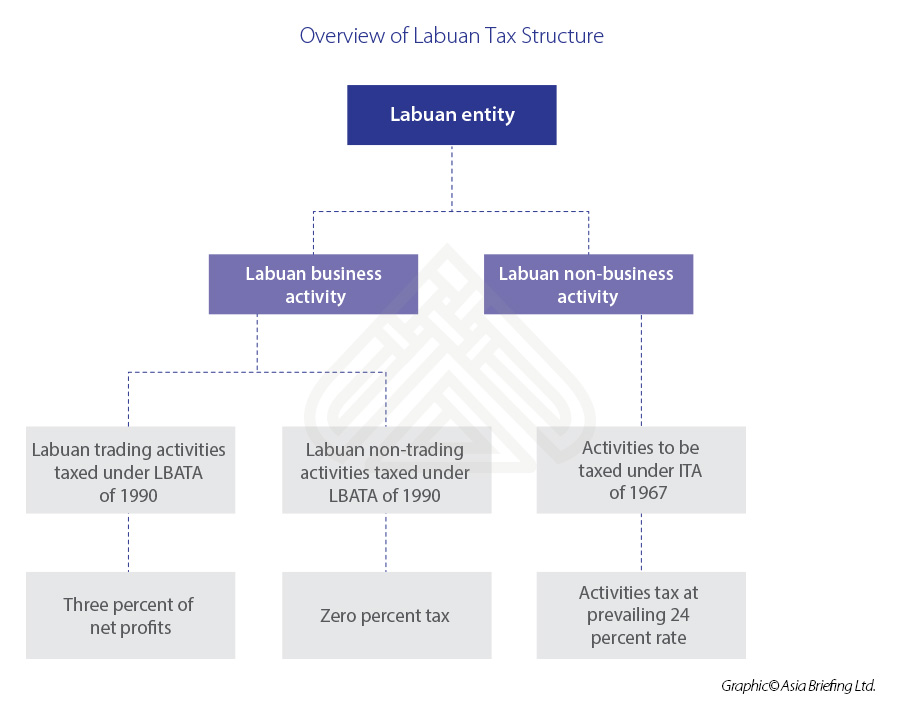

The Labuan International Business and Financial Center seeks to attract international Islamic businesses with tax incentives and a well-developed Shariah-compliant finance infrastructure. Labuan l ə ˈ b uː ə n. Labuan trading companies pay 3 corporate tax on their net income after doing an audit at the end of the year which is commonly observed on December 31st under the LBATA.

Labuan tax haven or myth. A 3 tax on net audited results A flat rate of Malaysian Ringgit MYR 20000 to trading companies. A Labuan entity continues to be able to make an irrevocable.

A Labuan entity that does not carry on a Labuan business activity or in carrying on a Labuan business activity does not have the adequate number of full time employees in Labuan or adequate amount of annual operating expenditure in Labuan will be subject to tax under the Malaysian Income Tax Act 1967. Some among the double tax treaty partners of. A trading company of Labuan carries out the activities of banking financing wholesale insurance management advisory consultancy import and export etc.

Malaysias tax haven Labuan to position itself as Islamic finance hub. Due to the territorys low tax environment and business-friendly regulations Labuan is a popular destination for foreign investors in Southeast Asia to base their operations. As a tax haven tiny Labuan doesnt rank among the worlds big namesbut officials from the Malaysian island are touring Asia touting the benefits of domiciling businesses in a place that.

A Tiny Malaysian Island Has Quietly Become A Favorite New Global Tax Haven Worldcrunch

Removal Of Labuan S Duty Free Status Breaches Govt S Promise Says Port Operator Free Malaysia Today Fmt

Understanding Labuan S New Tax Framework

The Tiny Malaysian Island That Wants To Be A Tax Haven Wsj

Labuan Tax Haven The Little Known Financial Gem Of Asia

Free Trade Zone Tax Haven World Map Simcenter

Understanding Labuan S New Tax Framework

Ayana Komodo Resort Waecicu Beach Labuan Bajo Updated 2022 Room Price Reviews Deals Trip Com

Offshore Company Formation Jurisdictions

British Empire Military Symbols East Africa British Empire Flag Africa Flag Imaginary Maps

Labuan Tax Haven Is Labuan An Offshore Jurisdiction

The Best Tax Haven In The World Labuan Bosco Conference

The Best Tax Haven In The World Labuan Bosco Conference

Labuan As Tax Haven In Malaysia The Understanding

Comments

Post a Comment